Buying a home is often considered one of life’s most significant financial commitments. While many prospective buyers are primarily concerned with the purchase price, there are several hidden costs that can catch first-time buyers by surprise. Understanding these expenses is crucial for budget planning and ensuring your dream home remains a sound financial investment.

1. Home Inspection and Appraisal Fees

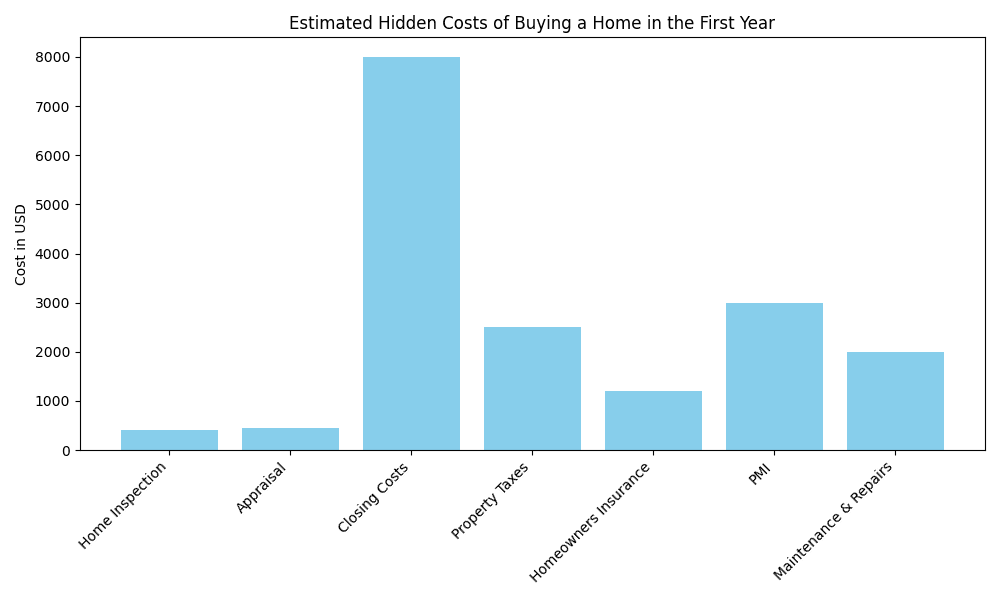

Before finalizing a purchase, it’s essential to know what you’re buying. A professional home inspection can reveal any underlying issues, such as structural damage or the need for major repairs. Additionally, lenders often require an appraisal to assess the home’s market value. These services typically cost between $300 and $500 each.

2. Closing Costs

Closing costs are the fees associated with finalizing a home purchase. These can range from 2% to 5% of the loan amount and include items like attorney fees, title searches, and loan origination fees. It’s vital to budget for these costs in addition to the down payment.

3. Property Taxes

Property taxes vary based on location and the assessed value of the property. These annual taxes are often paid in advance, and new homeowners might need to reimburse the seller for any prepaid taxes.

4. Homeowners Insurance

Obtaining homeowners insurance is typically a lender requirement. This insurance covers potential damages to the home from events like fires or natural disasters. Depending on coverage and location, costs can range widely, averaging about $1,200 annually.

5. Private Mortgage Insurance (PMI)

If your down payment is less than 20% of the home’s price, you might be required to pay PMI. This insurance protects lenders against default and typically costs between 0.3% to 1.5% of the original loan amount each year.

6. Maintenance and Repairs

Homeownership comes with the responsibility of maintaining the property. Whether it’s routine maintenance like lawn care or unexpected repairs like a leaky roof, these costs add up over time.

Conclusion

The journey of buying a home comes with various hidden costs that extend beyond the purchase price. By understanding and preparing for these expenses, prospective homeowners can better manage their budgets and reduce financial surprises. Our visualization highlights the importance of factoring these additional costs into your homebuying plans, ensuring a clearer and more comprehensive view of the financial commitment involved. Being informed about these expenses helps in making sound decisions and achieving a more seamless transition into homeownership.