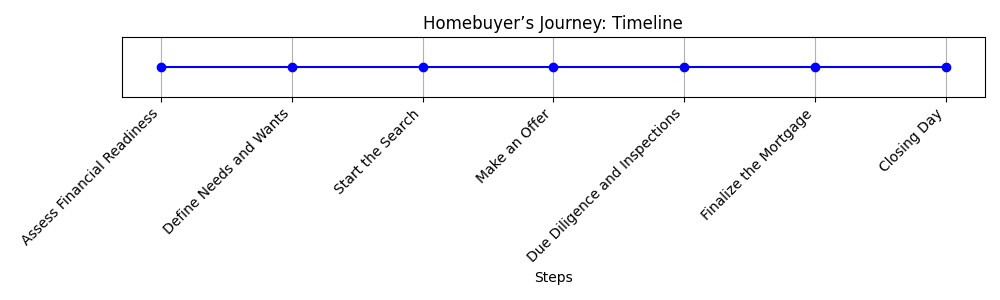

Embarking on the journey to buy your first home is an exciting, albeit daunting, adventure. It involves numerous steps, from envisioning your dream home to finally holding the keys in your hand. Knowing each stage of the process can smooth the path and transform the dream into reality with confidence. Let’s explore this journey step-by-step.

Step 1: Assess Your Financial Readiness

Before setting out to buy a home, it’s crucial to evaluate your financial situation. Assess your budget, considering your income, savings, and debt. Determine how much you can afford by calculating your potential mortgage payments and upkeep costs.

Next, you’ll need to secure financing. This involves getting pre-approved for a mortgage, which provides a clear idea of how much you can borrow and strengthens your position as a serious buyer when making offers.

Step 2: Define Your Needs and Wants

A crucial step in the homebuying journey is defining what you are looking for in a home. Make a list of must-haves and nice-to-haves. Consider factors like location, size, number of bedrooms and bathrooms, and amenities such as a garden or garage.

Step 3: Start the Search

Armed with a clear budget and a vision of your ideal home, you can begin your search. Online platforms and real estate apps offer easy access to listings. Remember to visit several properties to get a feel for what’s available and ensure it aligns with your expectations.

Step 4: Make an Offer

Once you find a home that fits your criteria, it’s time to make an offer. Your realtor will guide you in determining a fair price based on comparable sales in the area. This is also where negotiation skills come into play, as you may have to haggle over details like price, closing dates, or included fixtures.

Step 5: Due Diligence and Inspections

Upon acceptance of your offer, it’s essential to conduct thorough due diligence. This includes scheduling a professional home inspection to uncover any hidden issues, such as structural defects or outdated systems, which could affect your purchase decision.

Step 6: Finalizing the Mortgage

With the home inspection behind you, work with your lender to finalize your mortgage. This involves submitting necessary documentation and undergoing a credit check. Ensure there are no major changes in your financial standing during this time as it could affect your approval.

Step 7: Closing Day

Closing is the final step of the buying process, where you’ll sign paperwork to transfer the ownership of the home. This includes reviewing and signing the mortgage agreement and title deed. You’ll also cover closing costs, which can include fees for the loan, attorney, and other services.

Conclusion

The homebuyer’s journey, from initial financial assessment to closing day, is composed of crucial steps that require careful planning and guidance. By understanding each phase, potential homeowners can make informed decisions and turn their dream into reality. This timeline helps to visualize and conceptualize the progression, ensuring a smoother and more organized approach to purchasing a home. With the right preparation and a reliable realtor by your side, this journey can be both rewarding and fulfilling.